The Investors Dilemma

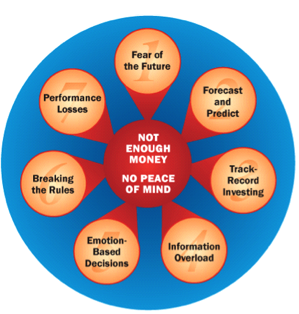

No matter how well it has been designed and implemented, an investment strategy by itself can never bring you peace of mind. Although most of the financial world likes to pretend that investment decisions are based purely on logic and rational thought, the truth is that the vast majority of investment choices are driven by emotional and psychological factors. The Dilemma outlines the typical process investors go through when facing important financial decisions.

In the end, the result of The Investors’ Dilemma is people who don’t have enough money to accomplish their most meaningful life goals and dreams. Not only are they not where they want to be financially, but they have also spent a large portion of their lives fraught with stress, anxiety, concern, and fear that initiate and perpetuate the dilemma.

At Evidence Based Investing, we help you break this vicious cycle. With knowledge and guidance, it really is possible to experience the peace of mind that comes with a lifelong investment strategy and end the investor’s dilemma forever.

Please join us for a workshop or come in for an initial consultation today.

The Investors’ Dilemma is a cycle that explains why many investment decisions are driven by emotional and psychological bias consistent with your values and goals. On the one hand, investors want assets to grow to an ideal state – to have enough wealth accumulated to meet personal financial goals. Yet, for most, this will only happen by investing money prudently. Therefore, investors need to make decisions and select strategies to maximize investments year after year. Unfortunately, the actions investors frequently take are likely to be self-defeating. Let’s look at how each step of this counterproductive cycle interferes with an investor’s ability to develop and maintain an ideal investment strategy.

The Investors’ Dilemma is a cycle that explains why many investment decisions are driven by emotional and psychological bias consistent with your values and goals. On the one hand, investors want assets to grow to an ideal state – to have enough wealth accumulated to meet personal financial goals. Yet, for most, this will only happen by investing money prudently. Therefore, investors need to make decisions and select strategies to maximize investments year after year. Unfortunately, the actions investors frequently take are likely to be self-defeating. Let’s look at how each step of this counterproductive cycle interferes with an investor’s ability to develop and maintain an ideal investment strategy.

1. Fear of the Future

The cycle begins with a sense of uncertainty about the future. Questions are prevalent. Questions like: “Will there be enough money to maintain my standard of living? How much do I need to save? How do I know what is the best investment?” The media and advertisers prey upon this fear of the future in an effort to sell products.

2. Forecasting the Future

Because of this fear of the future, investors have a strong desire to comprehend and predict future events…if some¬one could tell what is going to happen with inflation, long-term interest rates, share prices, overseas markets…then there would be nothing to fear. Along these lines, investors are frequently convinced that someone has the information, power and insight to forecast the future.

3.Track Record Investing

The primary method investors employ to convince themselves that the future can be foretold is Track Record Investing. This means they look for stock managers who have performed better than the market in the past, and hope that they will continue to have superior performance in the future.

4. Information Overload

In the past, gathering information was the best way to guide prudent investment decisions. However, the current Information Age has created access to so much information that it is easy to become overloaded. In the quest to find the right investments, investors feel compelled to expose them¬selves to all available information: internet, books, newspapers, magazines, TV talk shows, advertisements, friends’ experiences, etc. Indeed, instead of reducing fears and doubts about investment decisions, this deluge of information often intensifies them.

5. Emotion-Based Decisions

As investors we never overcome our own humanity. Even though most investors prefer to think that they make investment decisions based upon logic, it is typically emotions, such as trust, loyalty, hope, greed, and fear that drive investment decisions.

6. Breaking the Rules

There are three commonly accepted rules of investing: 1) Own equities; 2) Diversify; 3) Rebalance. The golden rule of investing is: Buy when prices are low and sell when prices are high. It sounds simple. However, when investors base decisions about the future on the past, they wind up breaking this rule, thereby sabotaging their portfolio

7. Performance Losses

Performance loss means investors fail to capture the returns they expected. Unfortunately, because investors so frequently break the golden rule of investing, they do not receive the rate of return they expected. Investor performance does not equal investment performance.

When this effect is compounded over a period of years, wealth potential for reaching financial goals is significantly decreased. Such loss creates additional frustrations and fears about the future, once again initiating the cycle.